Heritas Capital launches $30M fund for early stage startups in Asia

07 January 2021 | News

Seed and Series A stages funding across Asia for promising technology startups in the healthcare, education and food industries

Photo Credit: Freepik

Singapore-based Heritas Capital Management is launching a $30 million fund, focusing around 10 to 15 early-stage promising technology startups in the healthcare, education, and food industries which can bring social and environmental benefits as well as financial returns.

Heritas Venture Fund I (HVF) is Heritas Capital’s inaugural venture investing vehicle. Heritas Venture Fund II (HVF II) focusses mainly at Seed and Series A stages across Asia, continuing HVF’s successful investment strategy following an initial closing by first half 2021. HVF II will be a sub-fund under Heritas Capital Variable Capital Company (VCC), a new corporate structure tailored for investment funds launched by the Monetary Authority of Singapore (MAS) and Accounting and Corporate Regulatory Authority (ACRA).

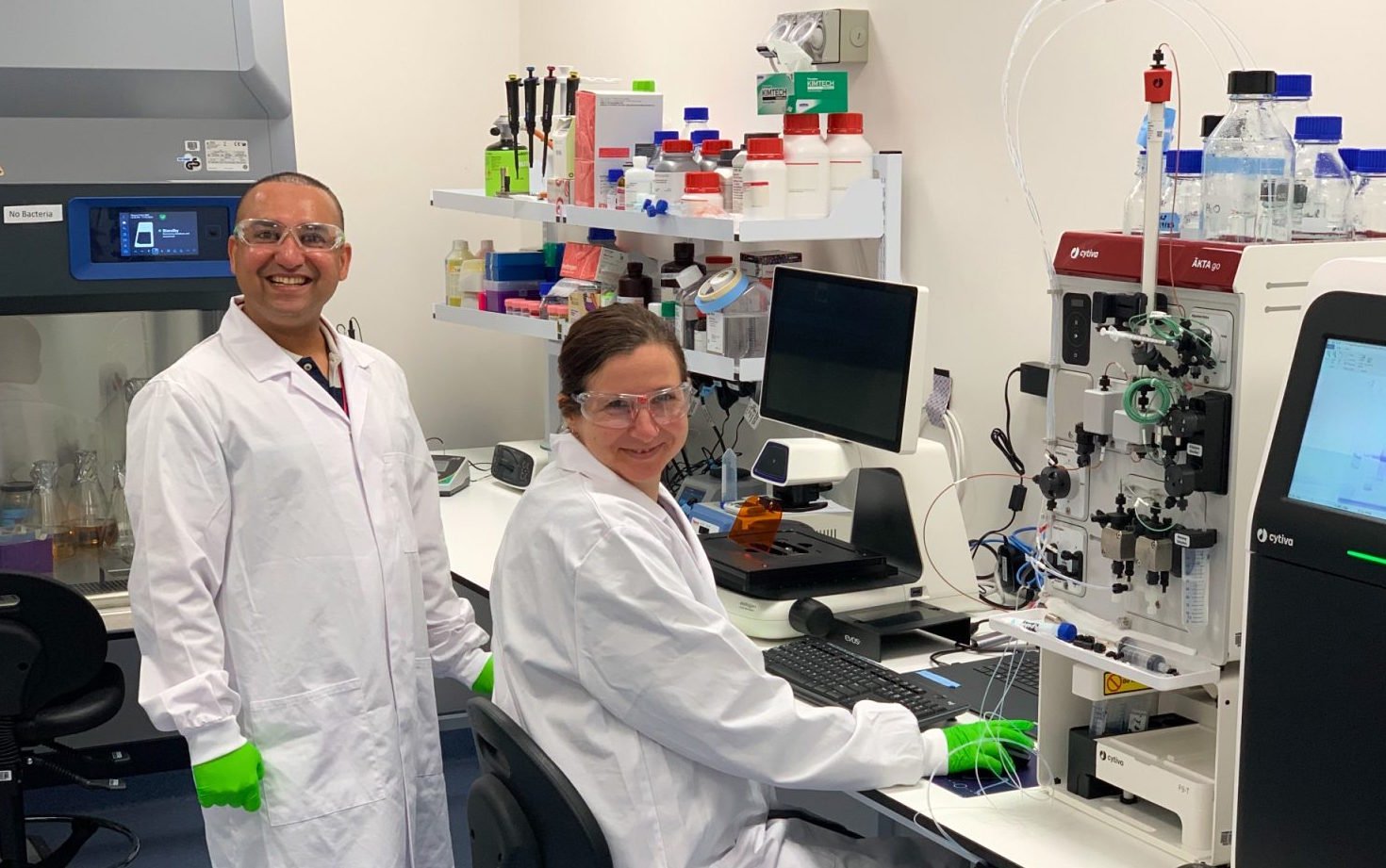

Since its inception in 2017, HVF has successfully invested in ten promising ventures including digital health startup Holmusk, biotech startup Hummingbird Bioscience, and foodtech startup Alchemy Foodtech. Many HVF portfolio companies have raised substantial follow-on funding from renowned investors amidst COVID-19 pandemic – Holmusk raised $20 million led by Optum Ventures in May 2020, Hummingbird Bioscience concluded a $25 million round led by Mirae Asset Venture Investment and SK Holdings in May 2020, and Alchemy Foodtech announced closing a financing round led by Thai Union Group PCL in December 2020. Heritas is also a co-investor with SEEDS Capital in several Singapore-based startups, including SilverConnect, a medical nutrition startup creating specialized food solutions for people with dysphasia.

“We are very glad to see the progress of our investments since launch, with strong traction of various portfolio companies exceeding our expectations,” said Chik Wai Chiew, CEO and Executive Director of Heritas Capital. “The planned launch of HVF II in 2021 comes at the right time where there has been growing interest in innovations across healthy living, lifelong learning and smart platforms accelerated by COVID-19 pandemic. We are seeing a strong pipeline of attractive deal flows which are also impactful in terms of enhancing access to affordable quality healthcare and education, and contributing to sustainable growth.”

Heritas Capital next will also launch a private equity fund - called Heritas Growth Fund III (HGF III) - with a targeted war chest of $150 million.