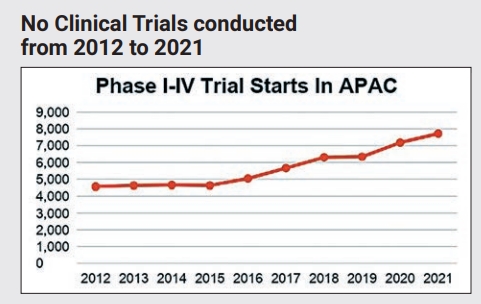

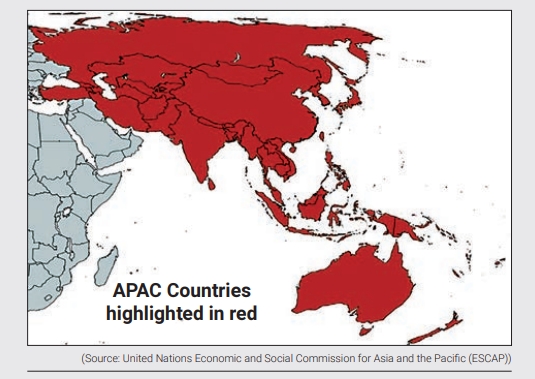

Over the past decade, the Asia-Pacific (APAC) region has emerged as a global leader in clinical trial conduct. In 2021, nearly half of all new clinical trials conducted globally were in the APAC region. This surge is evident in the significant rise in clinical trial-related activities in this region. From 2012 to 2021, the number of trials initiated in the APAC region (Phases I-IV) has nearly doubled, from 4,562 to 7,718, with an average annual increase of 5.4 per cent.

Notably, this growth has accelerated in recent years, with double-digit increases in new trial starts since 2016. In contrast, clinical trials outside of APAC have declined slightly over the same period, with an annual decrease of 0.4 per cent. This trend suggests that APAC could become the dominant region for clinical trials soon. This is a remarkable shift for a region that traditionally lagged behind the US and Europe, and it highlights APAC's position at the forefront of clinical research.

Why’s APAC Leading?

The rise of Phase I trials especially in the Philippines, Australia and Malaysia (Study sites at Penang Island) indicates that researchers in the APAC region are developing entirely new drugs rather than simply testing established drugs for global markets (Phase III) or monitoring their long-term effects (Phase IV). This suggests a growing number of drug discoveries by APAC companies, with China leading the way as the second-biggest R&D location globally. Other countries like South Korea, Japan, and Australia are also making significant contributions and advances in the field of research. Research shows that APAC holds 60 per cent of the global cardiometabolic disease burden and holds a lot of potential for clinical research.

Japan as a clinical trial hub

Major multinational drug companies favour Japan for their clinical trials in APAC. Nearly half of all trials conducted by the top revenue-generating pharmaceutical companies in the region have included Japan as a site in the past decade. Japan’s long history of positive reputation in clinical trials as well as Ivy League Japanese universities making their infrastructure compatible with high technology such as Decentralised Clinical Trials (DCT) in oncology, gene and cell therapy research environment are likely reasons behind this. Additionally, Japan holds a unique position as the only APAC member to be a founding member of both the regulatory (Ministry of Health, Labour and Welfare (MHLW) / Pharmaceuticals and Medical Devices Agency (PMDA) and industry the Japan Pharmaceutical Manufacturers Association (JPMA) sides of the International Conference on Harmonisation (ICH). Good regulatory guidance has helped Japan’s global position in clinical trials as well as ethnic sensitivity assessment.

Role of APAC’s huge population

With a massive population of nearly 60 per cent of the world, APAC is a goldmine for pharmaceutical and biotech companies seeking new clinical trial locations. The region has many ethnicities offering a unique chance to run clinical trials on a wide range of patients. This variety makes the results of these trials more applicable to a wider population and speeds up the process of finding study participants. The region offers several other advantages, including lower costs, simpler regulations, and also as government or insurance reimbursement for medical care is limited in many APAC countries, clinical trials provide patients with access to cutting-edge treatments that they wouldn't otherwise be able to get.

Apart from the large population in the APAC region, strict data standards and the availability of local data from research also drives clinical trial conduct in the region. Certain APAC countries, like Japan, Korea, and China, require local data for drug approval. Running trials in these countries allow companies to get approval and market in these countries while also potentially using the data for US and European approvals. China generally demands local data for phase 1 trials but might accept data from ethnically Chinese patients elsewhere. In addition, streamlined systems and efficient application processes with fast approval have given a boost to clinical trial conduct in the APAC region.

The APAC has transformed from a steady contributor to a dominant force in global clinical trial conduct. This surge is fuelled by a combination of factors, namely, the region's flourishing innovation in drug discovery and the continued presence of multinational pharmaceutical companies running multi-regional trials. China is poised to become an even bigger player, while other major APAC countries each offer unique advantages that make them attractive destinations for clinical trials.

Mohammad Imran, Global Head, Business Development & Operation, 3H Medi Solution, Japan