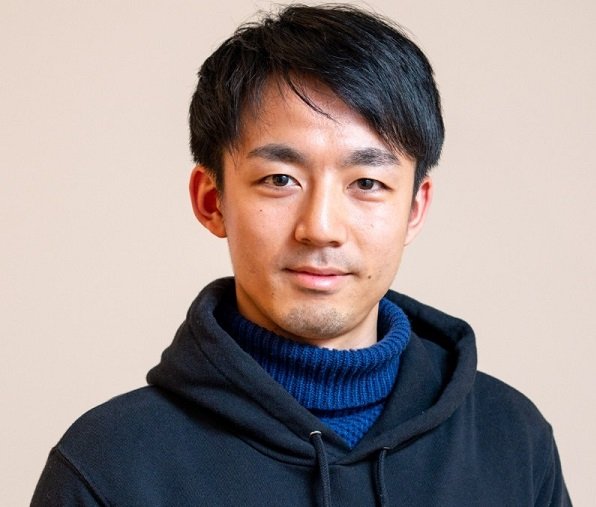

Venture capitals play a major role in providing financial support to startup companies through strategic investments/mentoring to enhance growth potential. Asia Pacific government agencies have also formed large funds to create new industries, with the increasing number of accelerators in the region. Japan is among the biggest investors in R&D and innovation globally, with a booming venture capital industry. One such Tokyo based Venture capital firm, Real Tech Holdings, boosts collaboration and investments in deep tech startups in Southeast Asia. Leading investments in the deep-tech sectors for healthcare, medical, food, AI and more, Real Tech is accelerating growth at global and APAC startup firms and also supporting entry into the Japanese market. Daiki Kumamoto, Global Fund Leader and Growth Manager at Real Tech Holdings, shares insights into Japan’s Venture Capital scenario and role of Real Tech in strengthening and bridging startup ecosystems in Japan and Southeast Asia.

How do you describe Real Tech’s fostering venture capital model and investment principles for the Asia Pacific startup arena?

Real Tech Holding is a joint venture between Euglena Co. Ltd. and Leave a Nest Co., Ltd., which are Japan’s leading deep-tech and knowledge platform companies. Real Tech Holding manages Real Tech Fund as Japan’s leading deep-tech focused venture capital funding firm. Euglena, is Japan’s top deep-tech unicorn, with a market cap nearing to $1 billion. Euglena is focused on biofuel, health supplements and healthy food products. Leave a Nest manages Japan’s largest academia-based knowledge platform that supports education, research and entrepreneurship. Facilitating collaborations between researchers and society to advance science and technology, Leave a Nest also manages a global deep-tech specialised seed acceleration programme named ‘Tech Planter’, including 6 countries in ASEAN, with more than 600 applications annually and also supports startups with their R&D, prototyping and manufacturing.

How do you map investment opportunities in APAC as per RealTech expertise?

Real Tech Fund started funding R&D-based technology in 2015 with the expertise of Euglena and the platform of Leave a Nest. Our investment areas vary from Life science, aerospace, robotics, agriculture, medical devices, marine technology, electronics, energy and new material. We have more than 50 well-known corporate collaborations under limited partnership (LP) with a total $200 million (22.8 billion JPY) investment.

With the initial investment of $82 million (9.4 billion JPY) into Japanese seed/early stage startups, we decided to expand our activities into the ASEAN region. Southeast Asia, with a total population being over 650 million, battles persisting unsolved issues such as plastic pollution, loss of biodiversity, waste in agriculture, poor medical environment and more. These concerns need immediate attention with appropriate investment policies and support.

The IT startup market has emerged over the past 10 years, yet there are no deep-tech startups in the Southeast Asia region that are valued more than $100 million. This could be primarily due to; Lack of investors with deep-tech investment knowledge and Lack of prototyping / manufacturing capability to support the growth of deep-tech startups despite the unique research themes that are emerging in universities and research institutes across Southeast Asia.

Can you elaborate the role of Real Tech ‘Global fund support system in creating a platform to penetrate the Japanese market and to collaborate with regional companies?

The Real Tech Global Fund initiated with $30 million (2.9 billion JPY) investment into deep-tech startups mainly in South East Asia, to interlink Japan and the SEA ecosystem. We seek to connect the startups to Japan’s ecosystem for significant R&D / business collaboration with corporates, factory groups and researchers. Real Tech facilitates various domain experts to provide hands-on support to startup portfolios to accelerate their business potential in the booming deep-tech sector.

As for incubation, our group company runs an incubation space called Center of Garage (CoG) in Tokyo, which stands as a unique incubation place where deeptech startups, Japanese ‘Super Factories’, and big corporations come together. Real Tech assists in accelerating innovations at global deep-tech startups space. Interactions among various stakeholders allows participants to experience the Re-Renaissance of Japanese ‘Monozukuri’. This activity solves manufacturing challenges across the globe by providing innovative solutions. Many of our current global portfolios are also seeking to use CoG as their main office for entering into the Japanese market.

How does Real Tech strengthen deep-tech healthcare sector investments in Southeast Asia?

Real Tech has formed strong partnerships with governmental institutes in various countries. In 2021, we were appointed as one of the 13 co-investment partners in the Deep-Tech field for Singapore’s government backed VC arm SEEDs capital (Southeast Asia’s most active venture capital investors). As an enabler of Singapore’s deep-tech ecosystem, SEEDS Capital partners with institutional co-investors from around the world to support Singapore-based innovative startups that possess break-through intellectual content and global market potential. In the latest appointment of co-investors, SEEDS Capital has broadened, diversified and refreshed its current pool of partners in the three deep tech sectors, (i) Manufacturing, Trade & Connectivity; (ii) Human Health & Potential; and (iii) Urban Solutions & Sustainability. Real Tech is the first Japan-based VC to be appointed in the Deep Tech field. With this, we are seeking to make our first co-investment to bridge Singapore and Japanese startup ecosystems.

Alongside with Singapore, we have also formed a partnership with the Malaysian government through Malaysian Technology Development Corporation Sdn. Bhd. (MTDC), who joined as a new limited investment partner into the Global Fund. MTDC is an affiliate of the Malaysian Ministry of Science, Technology and Innovation. Its mission is to support commercial implementation of technology in Malaysia through funding and investment, incubation and mentorship, entrepreneurship building and relevant advisory services. Currently, MTDC has actively invested in more than 700 companies, mainly startups through different specialised funds and has been recently focusing on the deep-tech sectors by partnering with various strategic partners with experience. Real Tech is the first Japan-based VC to partner with MTDC as a LP investor for co-investments and co-acceleration in Malaysia.

How do you summarise Real Tech’s visions in strengthening competitiveness at Japan’s Deep-tech market to accelerate domestic and overseas business expansion?

Investing into deep-tech must be sustainable. As of today, we have invested in 54 startups in Japan and 5 startups in ASEAN in which more than 30 per cent are to be categorised in the bio-tech, med-tech and healthcare sector. We see a huge potential in the region but have been able to invest mainly in Singapore.

Recent VC assistance from Real Tech involves various biotechnology and food science ventures across South-East Asia. One among them is, Singapore and Thailand based Austrianova, (a proprietary technology platform encapsulating living mammalian and bacterial cells) with which we have partnered through our ‘Enter to Japan Market Programme’. Leave a Nest Singapore, organises jointly with Enterprise Singapore (ES). Through our investment, we accelerate collaboration with Japanese business companies to support the expansion of applications and social implementation of Austrianova’s encapsulation technology mostly to our LPs.

Similarly, NDR Medical Technology Pte Ltd, a Singapore-based medical device company is also assisted by Real Tech to penetrate the Japanese market. This strategic partnership will accelerate collaboration with corporates, factories and research institutes in Japan. Real Tech has extended financial support to other technology portfolios like QD Laser (deep-tech vision care), Amelieff (bioinformatics analysis systems for medical / biotechnology research, clinical testing and drug discovery), Shiok Meats (cell-based seafood) and more to add on.

We have also built a strategic alliance with Japan’s leading law firm with significant deep-tech expertise to offer the best deep-tech specialised legal support in Japan which aligns IP strategy with the business and finance plan. Real Tech’s legal advisor and partners in Southeast Asia covers the whole region and provides a framework for filing/obtaining IP globally to our portfolio. Further, Real Tech looks forward to partnering and to extend collaborations in the global arena beyond Asia Pacific to find great bio-tech, med-tech and healthcare teams to change the world together.

Hithaishi C Bhaskar

hithaishi.cb@mmactiv.com