Asian biosciences industry shines with multiple innovations

May 31, 2023 | Wednesday | Opinion | By Bruce Liu, Partner, Life Sciences, Simon-Kucher, Greater China

COVID-19 was a wake-up call for the vaccine industry globally and in Asia, and a catalyst for vaccine R&D. Global majors like BioNTech, Moderna, MSD and Sanofi have unveiled plans to expand footprints in Asia, while local players are striving to catch up fast in developing novel vaccines, in addition focusing on other therapeutic areas like oncology and cell and gene therapy. With these developments Asia is emerging as a biosciences innovation hub.

When the global ADC leader SEAGEN announced a $2.6 billion deal to in-licence an ADC from RemeGen in 2021, many asked the same question: who is RemeGen?

RemeGen is a Chinese biopharma with a relatively short history and low profile, but has made remarkable strides establishing itself as an innovation leader in the Asian biosciences industry. Besides the billion-dollar disitamab targeting Her-2, RemeGen also has clinical stage assets targeting at mesothelin, c-MET and CLDN 18.2, all from its proprietary ADC platform; and besides ADC, its first-in-class fusion protein Telitacicept was launched in China for SLE, and is in multiple global trials for gMG and IgAN.

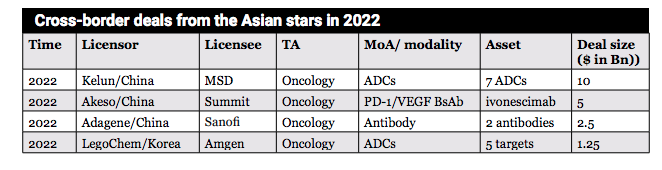

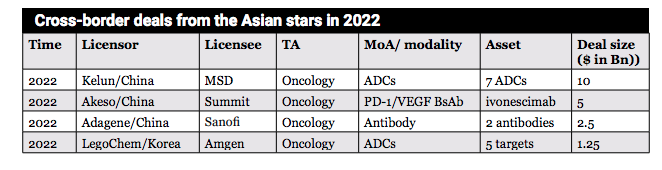

RemeGen is not alone in Asia spearheading world-class innovations. More recently, a number of cross-border deals emerged with more Asian stars in the spotlight.

Oncology as a key focus

Cancer continues to represent a huge disease burden to Asia, and some cancer types like gastric cancer, liver cancer and colorectal cancer feature disproportionately high prevalence, mortality, and high unmet needs in the region. Not surprisingly, many Asian companies have singled out oncology as their primary focus.

- Hengrui is a leading oncology company with a dominant position for its PD-1, CDK 4/6 and PARP inhibitors approved in China. Meanwhile, around 30 per cent of its revenue has been spent on its R&D, and its pipeline includes multiple antibodies, ADCs and PROTAC alike.

- BeiGene is well recognised for its world-class portfolio and R&D prowess and has expanded its footprints beyond Asia. Its BTK inhibitor zanubrutinib was the very first drug from China approved by FDA, and in a gusty head-to-head trial demonstrated superiority over ibrutinib, long perceived as the standard of care in r/r CLL patients globally.

- Chordia Science, a Japanese biotech focusing on developing next generation inhibitors that prevent or modify RNA deregulation. Its pipeline includes transcription inhibitors, splicing, RNA degradation, and tRNA recruitment, some in clinical stages and in partnerships with pharma majors.

Cell and Gene therapies gain momentum

Cell and gene therapy (CGT) in Asia has seen remarkable progress in the last three years. In fact, the number of CGT trials in Asia accounts for over half of the global trials.

- The China cell therapies space is seeing exciting developments, with Legend Biotech’s Cilta-cel as a front runner receiving approvals in US, Japan and EU, and many more in the pipeline targeting different cancer types including solid tumours. The gene therapy space is also seeing fast developments, with leading companies like Belief Biomed and GeneCradle zeroing in on haemophilia and Pompe disease with remarkable progress at advanced stages.

- Two South Korean biotech companies, GC LabCell and GC Cell joined in 2021, and in close collaboration with Merck to develop two CAR-NK candidates.

- Japanese startup Noile-Immune Biotech has entered partnership with Takeda for clinical stage assets targeting mesothelin and GPC3 in solid tumours. With its CAR-T cells genetically modified to simultaneously produce interleukin-7 and CCL19, they hold the promise to overcome the limitations of traditional CAR-Ts.

Catching up on novel vaccines

COVID-19 was a wake-up call for the vaccine industry globally and in Asia, and a catalyst for vaccine R&D. Global majors like BioNTech, Moderna, MSD and Sanofi have unveiled plans to expand footprints in Asia, while local players like CSPC and CanSino are striving to catch up fast in developing novel vaccines.

- In 2023, CSPC Pharmaceutical was granted emergency use authorisation (EUA) to market its COVID-19 vaccine, the first mRNA vaccine in China, while CanSino managed to secure approval for

the world’s first inhaled COVID-19 vaccine in 2022. The latter not only stimulates humoral and cellular immunity, but also induces mucosal immunity to achieve triple protection.

- In 2022, Takeda’s dengue vaccine Qdenga was approved in Indonesia, Europe and Brazil, marking a big win for the company after decade-long investment, and a big win for Asia’s biosciences industry as well.

Overall, the Asian bioscience industry has seen exciting developments and world-class innovations across multiple fronts, and more is to come with the strong drivers underpinning the momentum.

Bruce Liu, Partner, Life Sciences, Simon-Kucher, Greater China

(Inputs from Miranda Wang and Selene Peng, Consultants, Life Sciences Practice, Simon-Kucher Partners, Greater China)