Photo credit: Global data

Expectations for biosimilars are high in 2020, and the drug class will finally begin to make its mark in the US, says GlobalData, a leading data and analytics company.

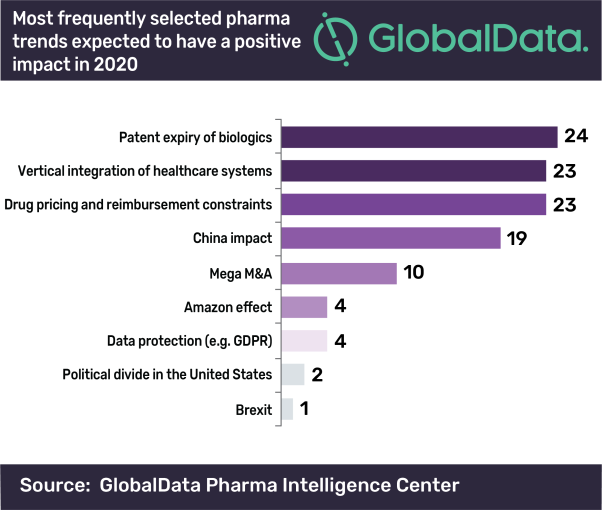

GlobalData’s latest annual outlook report, ‘The State of the Biopharmaceutical Industry – 2020’, reveals that 22% of global industry respondents believe patent expiry of biologics will have a positive impact on the pharmaceutical industry this year.

Bonnie Bain, PhD, Global Head of Pharma at GlobalData, comments: “Prior to 2019, few biosimilars had received US Food and Drug Administration (FDA) approval and those that did faced stiff legal battles. The tide appeared to turn in late-2019 when the FDA approved six new oncology biosimilars, including three for trastuzumab - Merck & Co’s Ontruzant, Pfizer’s Trazimera, and Amgen/Allergan’s Kanjinti.

“The FDA also approved Pfizer’s Ruxience and Zirabev, which are rituximab and bevacizumab biosimilars, respectively, as well as Sandoz’s Ziextenzo - a biosimilar of Neulasta. Pfizer launched Ruxience and Zirabev in January this year, and the company just announced that Trazimera will be available on February 15.”

The introduction of biosimilars into the immunology space has been a bit different in the US with numerous delays. Since 2016, more than ten biosimilars have been approved in the US, including four for infliximab (Johnson & Johnson’s Remicade) and five for adalimumab (AbbVie’s Humira), which is the number one selling drug worldwide. However, only two of the infliximab biosimilars have launched in the US to date, and their uptake in 2019 was low to moderate.

Bain continues: “The limited US market penetration in immunology was due to a number of factors, including stiff litigation challenges. For example, AbbVie has filed over 200 patent applications for various refinements to Humira or its method of manufacturing, which means that the launch of the first approved adalimumab biosimilar is delayed in the US until 2023. By contrast, several adalimumab biosimilars launched over the course of 2019 in Europe, where the immunology biosimilars market has become highly competitive.”

Despite the limited uptake of immunology biosimilars in the US in 2019, the successful launches of oncology biosimilars will likely have a knock-on effect for immunology. Amgen’s oncology biosimilars, Mvasi (Avastin) and Kanjinti (Herceptin) are now being used in the clinic and have been added to insurance formularies, including United Healthcare. Last week, Health New England released data showing that an initiative that launched in January 2019 has led to 93% utilization of infliximab biosimilars, yielding an estimated savings of $1.7m.

Bain concludes: “Another factor that could limit US biosimilar uptake in 2020 is their cost compared to the branded biologic equivalents. The price differential between biosimilars and their branded counterparts is only around 15–30%, and uncertainty still exists about their reimbursement, automatic substitution, competition from next-generation biologics and litigation. However, the fact that insurers have begun to place biosimilars on the primary tier of their formularies bodes well for biosimilars in 2020 and beyond.”