Takeda Pharmaceuticals has released its financial report for the fourth quarter of 2024, showcasing strong financial performance, significant revenue growth, and strategic advancements in research and development. The company has continued its trajectory of innovation, particularly in the areas of gastrointestinal, oncology, plasma-derived therapies, and rare diseases. Below is a comprehensive summary of the key highlights from the report.

Financial Performance

Revenue and Profitability

Takeda reported total revenue of JPY 3,528.2 billion, reflecting a 9.8% year-over-year (YoY) increase. This growth was primarily driven by strong performances in the United States, Europe, and emerging markets, with increased sales in oncology and plasma-derived therapies.

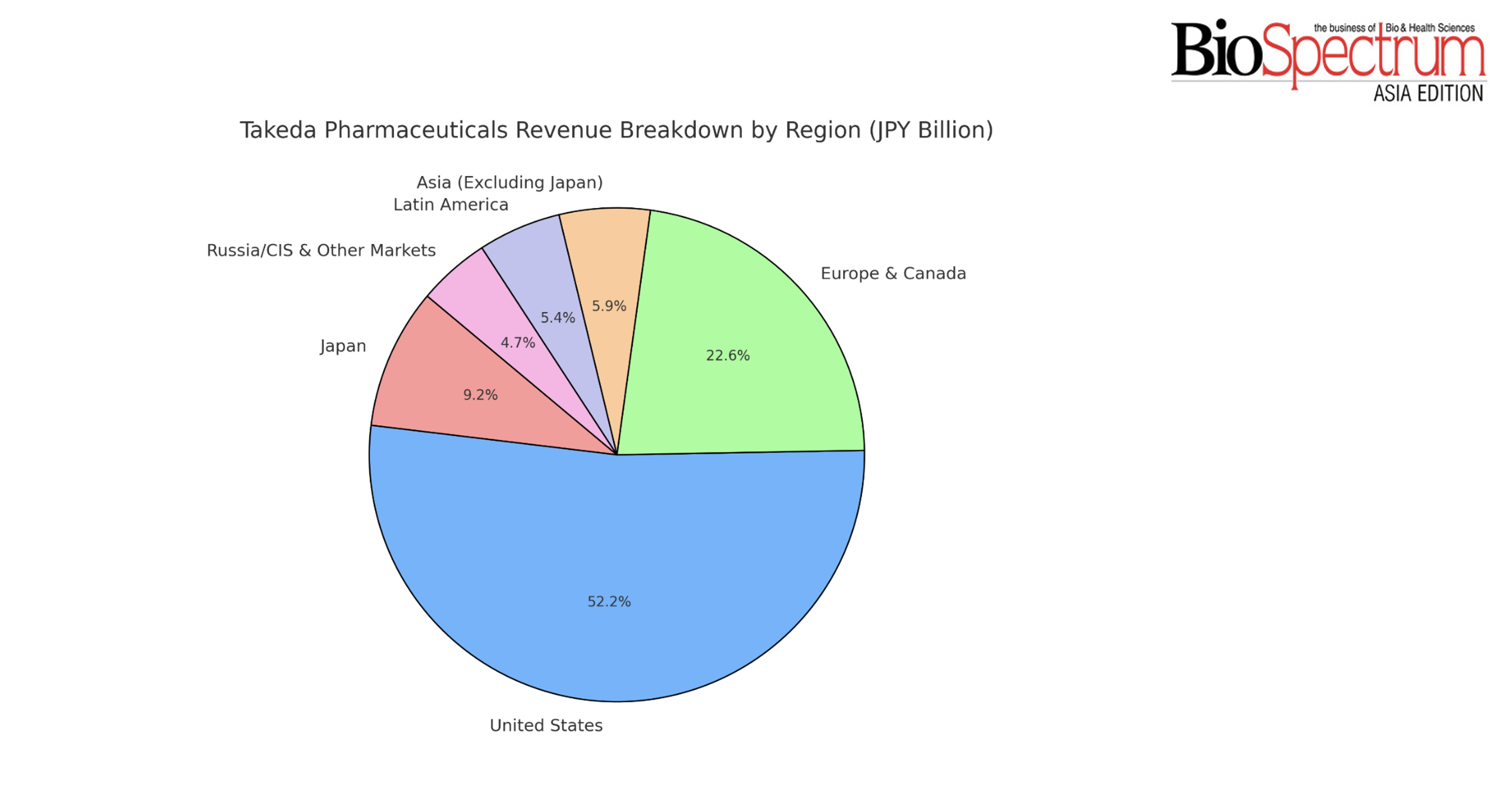

Revenue by Region

Takeda Pharmaceuticals reported strong regional revenue growth in Q4 2024, with notable increases across most markets. The United States remained the company's largest market, generating JPY 1,841.4 billion, reflecting a 9.3% year-over-year increase. Europe & Canada also performed well, contributing JPY 795.6 billion, a 10.3% rise driven by strong demand in key therapeutic areas. Asia (excluding Japan) saw an increase of 10.8%, reaching JPY 209.2 billion, fuelled by expanding market penetration. In contrast, Japan experienced a 5.2% decline, with revenue falling to JPY 324.7 billion, likely due to increased generic competition and pricing pressures. Meanwhile, Latin America recorded the highest growth rate at 38.2%, reaching JPY 191.2 billion, reflecting expanding sales and favourable market conditions. Lastly, Russia/CIS and other markets saw a 23.7% increase, totalling JPY 166 billion, indicating solid growth in emerging regions.

Core Operating Performance

Business Segment Performance

Takeda Pharmaceuticals experienced notable shifts in revenue across its key business areas in Q4 2024, with most segments showing strong growth. The Gastrointestinal (GI) segment led the way with a revenue increase of JPY 103.2 billion (+11.0%), reaching JPY 1,039.3 billion. The growth was primarily driven by ENTYVIO, which saw a 12.9% increase in sales, largely due to strong demand in the U.S. and Europe, along with the expanded use of its subcutaneous formulation. Additionally, GATTEX/REVESTIVE revenue surged by 25.9%, supported by increasing demand in the U.S. and expanded indications.

The Rare Diseases segment grew by 10.4%, reaching JPY 579.0 billion. TAKHZYRO, for hereditary angioedema, saw a 23.2% increase due to strong market demand in the U.S. and Europe. LIVTENCITY, for post-transplant cytomegalovirus, reported exceptional growth of 75.5%, reflecting strong penetration in the U.S. and expanded availability in new markets. Enzyme replacement therapies like ELAPRASE and REPLAGAL also contributed to the segment's revenue growth.

Plasma-Derived Therapies (PDT) posted JPY 784.2 billion in revenue, reflecting a 16.3% increase. Immunoglobulin products like GAMMAGARD LIQUID/KIOVIG, CUVITRU, and HYQVIA experienced strong double-digit growth, driven by rising global demand and favourable foreign exchange rates. Albumin products, including HUMAN ALBUMIN and FLEXBUMIN, also saw steady gains.

The Oncology segment saw impressive growth, increasing by 23.7% to JPY 428.4 billion. A major driver was the launch of FRUZAQLA, which generated JPY 36.1 billion, marking an extraordinary 1,512.9% increase following its U.S. launch. ADCETRIS continued its strong performance in malignant lymphomas, posting an 18.2% increase. Sales of ICLUSIG, for leukaemia, jumped 32.2%, benefiting from its expanded U.S. label approval.

Vaccines saw the most substantial percentage increase, rising 69.1% to JPY 49.9 billion, mainly fuelled by the success of QDENGA, a dengue vaccine, which experienced an astounding 418.5% increase in sales as it expanded to more than 25 countries. However, this growth was partially offset by the termination of Takeda’s SPIKEVAX COVID-19 vaccine contract in Japan, though the approval of NUVAXOVID for the Omicron JN.1 variant helped mitigate the decline.

Conversely, Neuroscience declined by 3.9%, generating JPY 456.5 billion in revenue. The biggest setback came from VYVANSE/ELVANSE, which saw sales drop by 8.1% due to generic competition in the U.S., though market expansion in Europe provided some relief. ADDERALL XR also struggled, with a 32.2% decline due to increased availability of generics. On the positive side, TRINTELLIX, an antidepressant, saw a 22.3% increase in revenue, supported by strong growth in the U.S.

The Other category, which includes smaller product lines, saw a 16.1% decline, bringing in JPY 190.9 billion.

Research & Development and Pipeline Developments

Takeda’s Clinical Development Activities as of January 30, 2025, include a pipeline of assets at various stages of development, either pursued independently or through partnerships. The pipeline is dynamic, with therapeutic candidates entering and exiting based on clinical trial outcomes, regulatory approvals, and market conditions. The listed assets primarily focus on obtaining regulatory approvals in the U.S., EU, Japan, and China, though development efforts extend to emerging markets. The table highlights key drugs under pivotal clinical studies, along with those already approved in specific regions where Takeda holds commercialization rights.

The assets are categorized based on their modality, including small molecules, peptides/oligonucleotides, cell and gene therapy, and biologics. Stage-ups in the pipeline are recognized when the First Subject In milestone is achieved unless otherwise stated.

Financial Position & Cash Flow

Takeda Pharmaceutical has shown significant improvement in its financial position and cash flow for the upcoming fiscal year. The company anticipates operating cash flow to reach JPY 835.0 billion, a substantial increase of 90.8% compared to the previous year. This robust growth in operating cash flow is attributed to Takeda’s focus on improving operational efficiency and managing working capital more effectively, which is expected to result in better liquidity and stronger financial flexibility. Furthermore, Takeda expects an extraordinary increase in free cash flow, projecting a 1,466.3% rise to JPY 568.3 billion. This remarkable surge in free cash flow reflects the company’s ability to generate substantial cash from its core operations while effectively managing capital expenditures, thus allowing for more strategic investments and returning value to shareholders. In terms of its financial leverage, Takeda has made considerable progress in reducing its debt. The company’s adjusted net debt-to-EBITDA ratio is projected to improve from 3.1x to 2.7x, a clear indication of its enhanced ability to service its debt obligations. This reduction in leverage is part of Takeda’s ongoing commitment to strengthening its balance sheet and ensuring long-term financial sustainability. These improvements in cash flow and debt management position Takeda well for future growth and operational flexibility, reinforcing investor confidence and financial stability.

Outlook for FY 2025

Takeda Pharmaceutical has provided its financial outlook for the fiscal year 2025, showing promising growth across several key metrics. The company forecasts total revenue to reach JPY 4,590 billion, marking a 2.5% increase compared to the previous year. This revenue growth is primarily driven by strong performances in Takeda's key therapeutic areas, including oncology, gastroenterology, and neuroscience, as well as new product launches and expanding market reach. Takeda projects operating profit to rise significantly, expecting an increase of 29.8%, which would bring the figure to JPY 344 billion. This substantial growth in operating profit is a result of both higher revenues and improved operational efficiencies, which will contribute to a more profitable core business. The company anticipates net profit to soar by 73.5%, reaching JPY 118 billion, reflecting a favorable impact from non-operating factors such as reduced financial costs and higher income from investments. Additionally, Takeda is forecasting core earnings per share (EPS) to grow by 11%, bringing it to JPY 507, indicating solid profitability and enhanced shareholder value. These expectations are built on a strategic focus on expanding its global footprint, optimizing its product portfolio, and achieving operational excellence.

Conclusion

Takeda has demonstrated a strong financial performance in Q4 2024, bolstered by revenue growth, strategic R&D investments, and disciplined financial management. The company is well-positioned for continued growth in FY 2025, with a focus on expanding its key product lines and maintaining innovation leadership in pharmaceuticals.