image credit- shutterstock

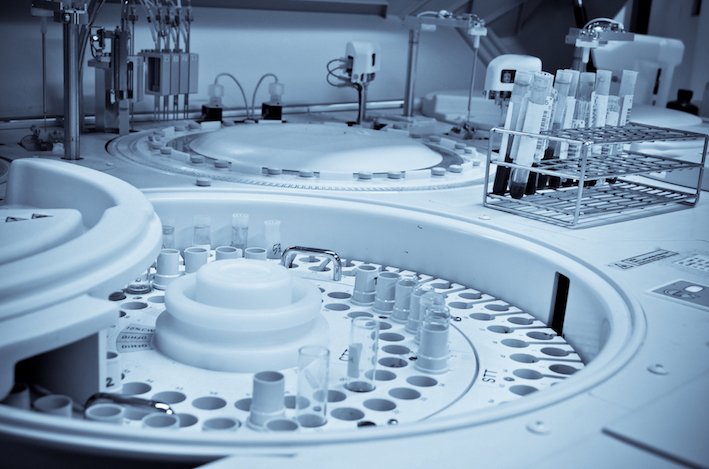

Companies in the pharmaceutical sector have been facing fierce competition, cost pressure, technological innovations, and increased consolidation activities. Though the demand for generic medicines and biologics is exponential, high capital expenditures to set up complex manufacturing requirements and state-of-the-art technologies can not be ignored. To overcome these scenarios, the pharmaceutical sectors are progressively relying on CDMOs for clinical candidate development, manufacturing, candidate registration, and market authorisation. Pharmaceutical companies are revisiting their cumbersome production processes by exploring CDMO facilities to manage company resources and assets effectively with regulating expenditure.

“CDMOs like us have the technical expertise, knowledge, and GMP facilities to deliver cost-effective development and manufacturing services. Outsourcing to a CDMO means you can expand your technical capabilities without the burden and associated risks of investing in expensive equipment” says Rutger Vandiest, Director of Business Development, Jabil Healthcare.

Through CDMO outsourcing, companies can cut down substantial capital investments in building in-house technical strengths and focus on pipelines and commercial priorities. Thus, CDMO is destined to share the major segment of pharma/Biopharma production stage activities owing to the factors such as the high demand for end-to-end services in big pharmaceutical companies, execution costs, growing pricing pressures, and pipeline challenges.

Fragmented market Landscape with diversified offerings

The APAC region remains the preferred CDMO growth market due to lower manufacturing costs than in North America and Europe, though the US continues to be the primary hub for pharmaceutical development outsourcing. Several factors, including large amounts of funding and the presence of university-affiliated pharmaceutical research clusters, could be the possible reasons.

The one-stop destination for pharma covering the entire value chain, from drug discovery, product development, and manufacturing services to commercialisation, the global CDMO market is expected to grow from $168 billion in 2021 to $215 billion by 2026, at a CAGR of 5 per cent during the forecast period of 2021-2026., as per the BCC report.

The dominant top players controlling the global stage are just under 25 per cent of the market with approximately 500 small and medium-scale CDMOs around the world, says market research and intelligence platform, MarketsandMarkets. Nevertheless, pandemic has created a growing demand for vaccines and biosimilars, which are creating opportunities for SMEs in the CDMO space, mainly, in key market niches.

Among standard portfolios, Solids (tablets, capsules), Sterile liquids, Semisolids, and non-sterile liquids (creams/gels), the sterile liquids sector holds a larger share in CDMO services with increasing demand, whereas solid dosage forms have been the most dominant sector of all time. Growth in the sterile liquids segment is primarily driven by the growing demand for biologics in the post-pandemic era.

High-potency active pharmaceutical ingredients (HPAPIs) like small molecules have been the long-time essentials for drug development. Though small molecules constitute 90 per cent of drug sales being the primary active substance choice for pharmaceuticals, the emergence of CDMOs has brought focus on complex large molecules for better profit. The rise in popularity and importance of the development of large molecule drugs has introduced ‘biologics’ to the industry.

Click here to read the full story....