Boston Scientific to acquire Rhythmia Medical

09 October 2012 | News | By BioSpectrum Bureau

Boston Scientific to acquire Rhythmia Medical

Boston Scientific to acquire Rhythmia Medical for an upfront payment of $90 million and an additional $175 million in contingent payments

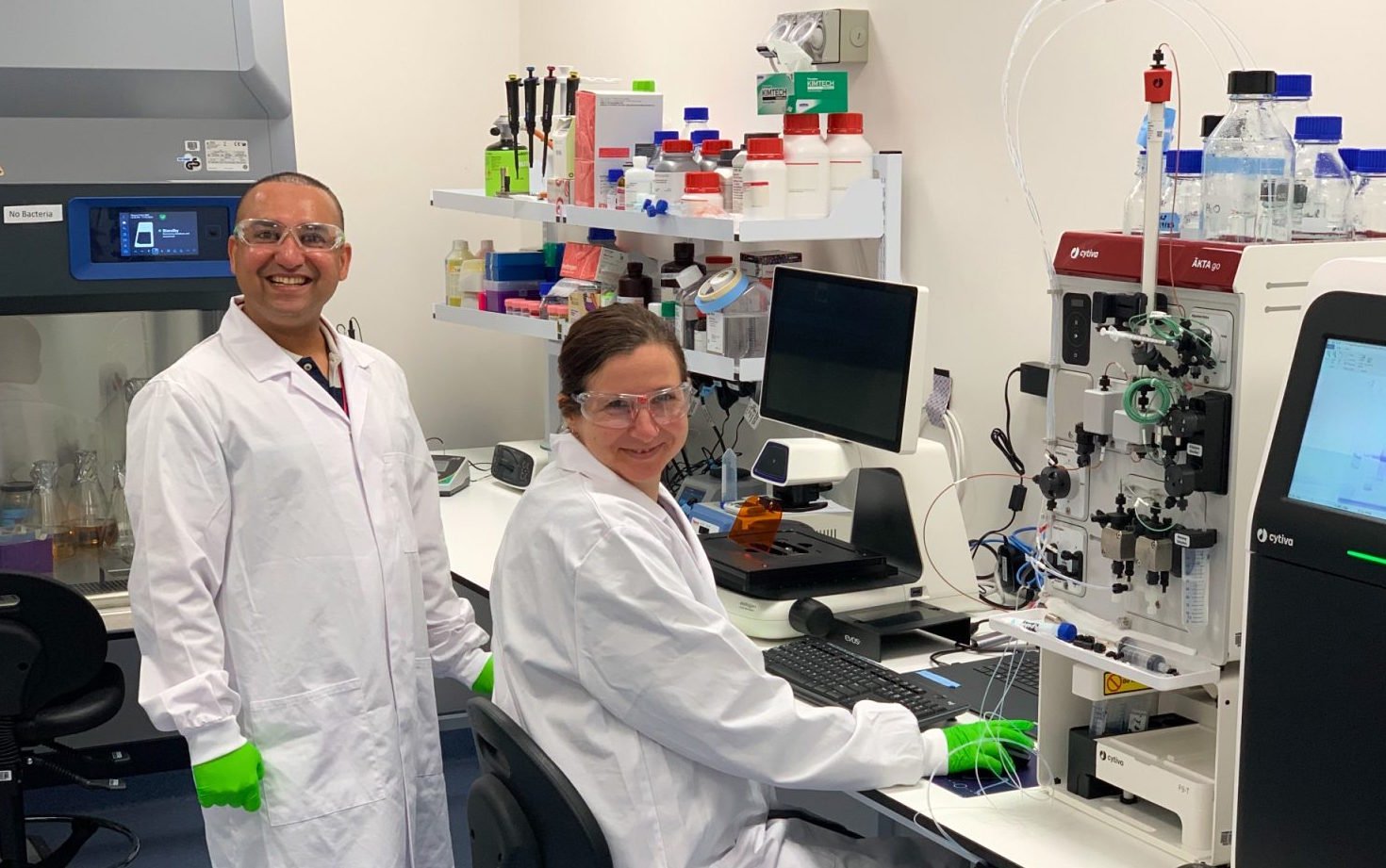

Singapore: Boston Scientific has entered into a definitive agreement to acquire privately-held Rhythmia Medical, a developer of next-generation mapping and navigation solutions for use in cardiac catheter ablations and other electrophysiology procedures, including atrial fibrillation and atrial flutter. The transaction is expected to close by October 12, 2012.

Mr Hank Kucheman, CEO, Boston Scientific, said that, "Electrophysiology is a $2.5 billion market and growing at a double-digit pace, representing a key growth opportunity for us. Rhythmia Medical has a strong and impressive team, and its technology is expected to add innovation and breadth to Boston Scientific's suite of solutions in this strategically important space."

Mr Doron Harlev, co-founder and co-chief executive officer of Rhythmia Medical. "Our system is expected to become a very promising tool for physicians to treat patients with complex cardiac arrhythmias. We are excited to combine our mapping system with Boston Scientific's strong catheter platform and commercialization capabilities."

Once the mapping system is cleared by the US FDA and receives CE Mark approval in Europe, Boston Scientific expects to begin a limited market launch of the system in 2013 and full market launch in 2014.

The agreement calls for an upfront payment of $90 million payable upon transaction closing, and up to an additional $175 million in contingent payments based on regulatory, commercial, and sales-based milestones through 2017. Boston Scientific currently expects the net impact of this transaction on adjusted earnings per share to be immaterial for years 2013 and 2014 and break-even to accretive thereafter, and more dilutive on a GAAP basis as a result of acquisition-related net charges and amortization, which will be determined during the fourth quarter.