Kolmar Korea sells off pharma biz to IMM Private Equity

02 June 2020 | News

Sellout is the part of the company's developmental restructuring of the pharmaceutical business from a long-term perspective and with the hope to improve financial structure by repaying short-term debts

image courtesy: pexels

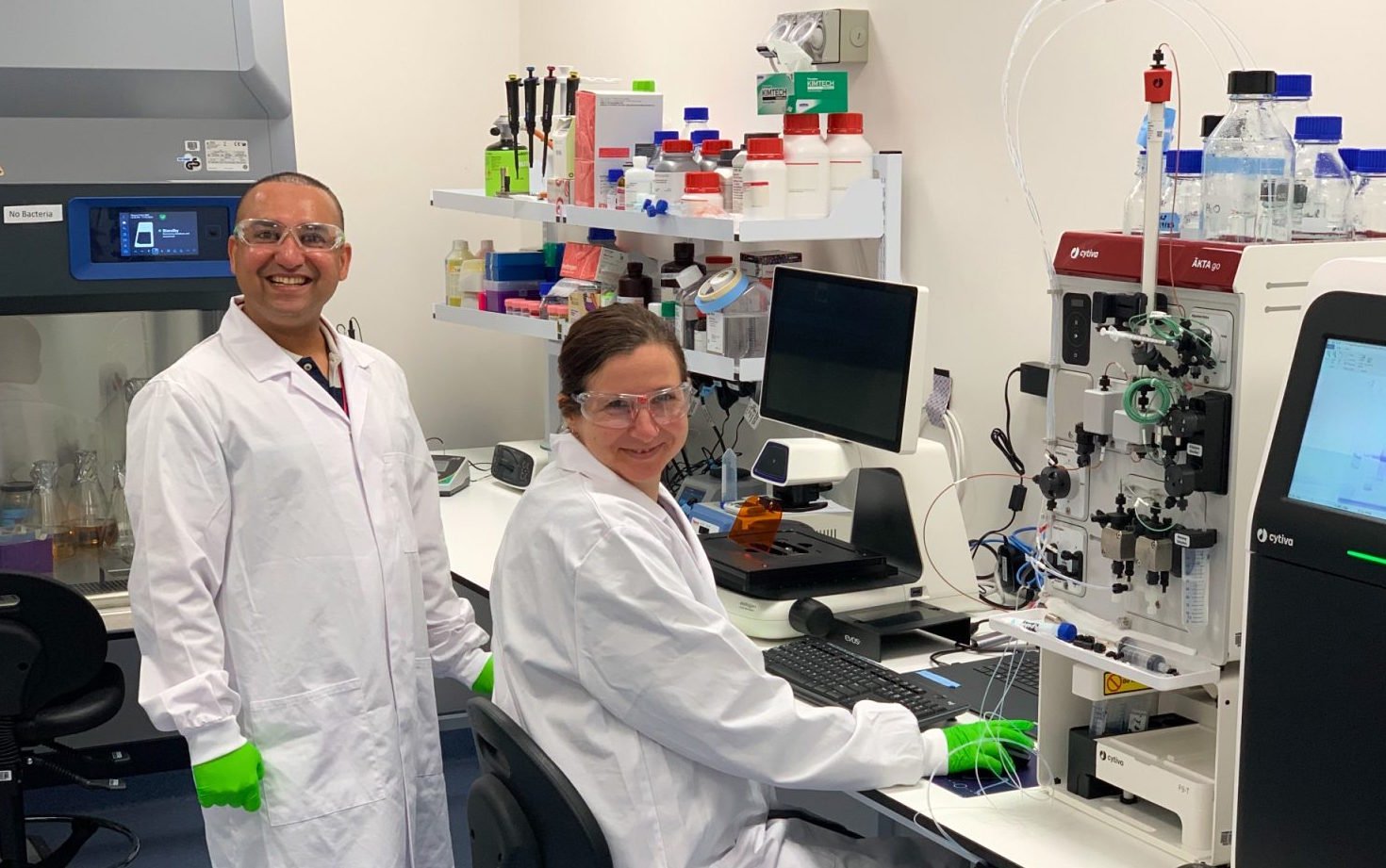

Kolmar Korea has announced that it would sell its pharmaceutical business unit and Kolmar Pharma, a subsidiary of the company, to IMM Private Equity, one of the nation’s largest private equity funds.

The company mentioned that it would hand over all of its shares in Kolmar Pharma and its pharmaceutical business unit for 512.4 billion won ($423.4 million) -- 176.1 billion won for Kolmar Pharma and 336.3 billion won for Korea Kolmar's business unit. Kolmar Korea said that its toothpaste business, which is part of its pharmaceutical business unit, will not be included in the sale.

"The sale of the pharmaceutical business is to improve the company's financial structure and reorganize the group's business platform," the company said. Through the sale of its pharma business, the company plans to focus on its cosmetic business, while consolidating its pharmaceutical business through its subsidiary HK inno.N, formerly known as CJ Healthcare. The two companies plan to finalize the procedure by July 31.

Kolmar Korea's annual financial expenses were estimated to have increased by about 40 billion won due to the business transactions, while its total debt and net debt reached 1.5 trillion and 994 billion won, respectively, in 2019. Such liabilities increased the company's annual interest expense to 53.4 billion won, almost half of the company's operating profit during that year (117.8 billion won).